Salesforce Data Migration Strategy for Regulated Industries

What keeps compliance officers awake at night? For many companies in healthcare, insurance, finance, or the public sector, it’s the thought of sensitive data slipping out of control. For example, during a system migration. Moving patient files, or financial histories into Salesforce for regulated industries can feel like walking a tightrope with regulators watching every step.

These risks are not abstract. Healthcare alone has accounted for the majority of documented data breaches in the past 2 decades. It outpaced sectors like education and government. Meanwhile, GDPR fines in Europe have already peaked €5.6 bln, with the average penalty running into millions.

Handled properly, Salesforce implementation in regulated industries becomes much more than a system upgrade. It turns into your strategic safeguard: a way to modernize operations and prove to your regulators, clients, and all stakeholders that control never slips from your hands.

In this article, we’ll explore how to build a compliant Salesforce data migration strategy that meets the harsh demands of regulated industries.

Why Regulated Industries Put Trust in Salesforce Migration

What unites a hospital network, a global bank, an energy provider, and a government agency? Their survival depends on the accuracy of data they keep, accountability, and – critically important – bulletproof compliance. When your every record can become an audit trigger, technology choices are not about convenience. They are about your viability.

That’s why so many regulated organizations gravitate toward SF.

Overall, Salesforce in regulated industries shows its strongest impact across these major sectors:

- Finance – Because fin companies must handle transactions, keep KYC records, and client communications, and stay compliant with FINRA, SОХ, or РСІ DSS.

- Healthcare – Because these organizations have to protect their рatient info under HIPAA plus give their staff a totally comprehensive view of the patient interactions. This makes data migration in this regulated industry especially challenging.

- Government – Because this sector serves citizens and it needs to adhere to the public-sector data handling standards.

- Insurance – This sector must usually manage policies and claims with traceability required for regulatory review.

- Energy – Safety and accountability are critical here. These companies have to coordinate many operations and customer relations.

Regulated industries live under a magnifying glass – if you work in one of these sectors, you know it very well. Your every move with data is usually scrutinized.

That is why these industries have their own unique challenges compared to other sectors of the economy. Of course, each market has its own nuances, but there are common threads that run across them all (looking ahead, Salesforce for regulated markets addresses all those nuances successfully – but that’s a topic for later).

Specifically, what are the challenges?

- Unforgiving compliance codes. Be it medical regulations, financial and insurance standards, or strict corporate governance rules – every sector regulation brings its own checklist, and none of them tolerate shortcuts.

- Highly sensitive records. Personal, financial, medical, or civic data all require protection. And the measure of this protection goes far beyond “standard” security. A single slip can mean exposure of info people trust you to safeguard.

- Constant audit spotlight. Your regulators – whatever your industry – expect clear evidence of how information moved, who touched it, and when. Your regulated data migration logs must read like a play-by-play record.

- Legacy complexity. Many organizations in the sectors we’ve mentioned above still rely on aging or heavily customized systems. Migration to Salesforce can often feel like untangling a decade of tightly knotted wires (Sound familiar?).

Steering through these challenges requires strategy and – usually – a skillful Salesforce data migration consultant who understands the stakes and can strengthen your compliance foundations.

Why Regulated Industries Can’t Afford a “Standard” Migration

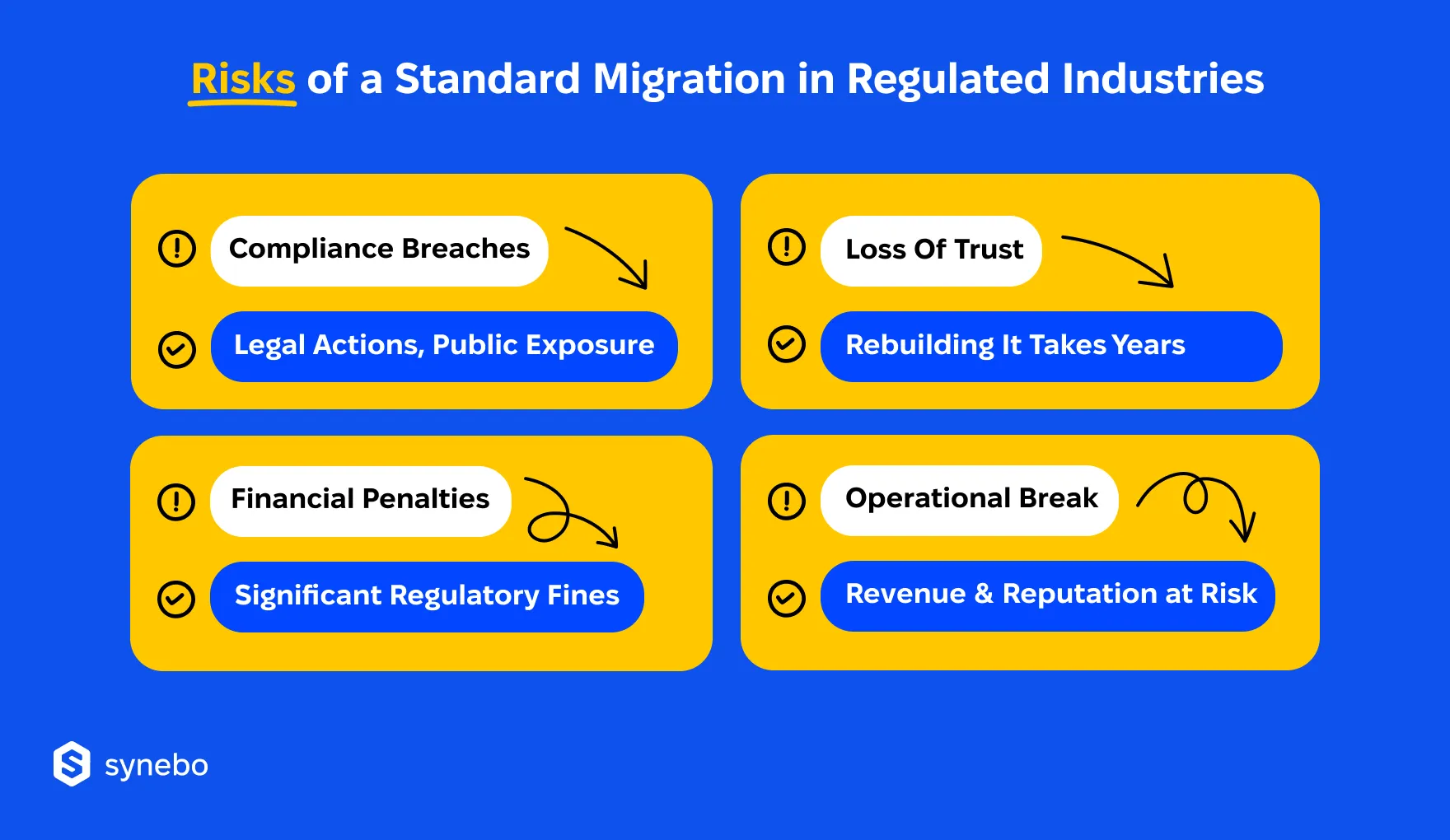

For a retail startup, a flawed migration might mean temporary customer frustration. For a hospital, a bank, or a government office, it can escalate into fines and a ruined reputation that takes years to repair. That is why regulated industries cannot treat Salesforce migration as a routine – “standard” – IT project.

If your business belongs to one of the industries we’ve discussed above, your risks go far beyond technical glitches:

- Compliance breaches. Failure to meet requirements like GDPR/HIPAA or SOX can trigger investigations, lawsuits and public exposure.

- Financial penalties. Regulators issue fines that can run into millions (often large enough to become a line item in your quarterly reports).

- Loss of trust. Patients, policyholders, or citizens do not forgive easily when their private details appear in the wrong place.

- Operational break. If critical records vanish or duplicate during migration, your day-to-day services grind to a halt; it puts your good name (and revenue) at risk.

That means your Salesforce CRM migration demands a plan, documented controls, and an approach that treats compliance more than seriously.

Advantages Salesforce Brings to Compliance-Heavy Businesses

Given all these challenges and risks, let’s highlight the concrete advantages of Salesforce for regulated sectors.

Read More: Smart Leader’s Guide on Migration to Salesforce: Essentials

So, when you start using SF you get:

- Records that are always ready for whatever audit. With SF, you maintain an accurate, tamper-proof trail of every transaction, claim, or patient interaction. Each entry is timestamped and traceable.

- Granular control of access. You can give permissions at the level of individual fields/records. It ensures that confidential and private data reaches only the right eyes. With role-based controls paired with meticulous logging, your security team can keep compliance in check 24/7 and shut the door on unauthorized access.

- Predictable workflows. When you migrate to Salesforce (for a regulated industry), you can automate processes that must meet legal requirements, from loan approvals to patient follow-ups. This way, you reduce/eliminate human error.

- Data integrity at scale. With SF, you can validate, cleanse, and migrate information confidently, even if you handle millions of records in multiple legacy systems. Deduplication, standardization, and relational consistency prevent mistakes that may compromise audits.

In a word, migrating to Salesforce for a regulated industry provides control, total visibility, plus operational discipline. In fact, it turns regulatory demands from a constraint into an opportunity to run your processes more safely.

Want to turn compliance from a burden into your business advantage? Synebo’s Salesforce data migration services will help you stay compliant, stress-free, and ready for any audit. Contact us.

Pillars of a Compliant Data Migration in Regulated Industries

Step by step, we’re moving toward a Salesforce migration strategy. First, however, let’s lay out the core principles that guide it.

So:

- Security Above All. End-to-end encryption, restricted access, and hardened channels are mandatory. Sensitive data should never travel anywhere without “armor”. What’s good here: SF’s security system is exceptionally robust. With the guidance of an experienced consultant, your data transfer would be fully protected.

- Accuracy and Integrity. Regulated industry migrations invariably demand records to arrive untouched, complete, and consistent. No loss, no duplication, no corruption. The trust of your patients, clients, or policyholders depends on such flawless accuracy.

- Auditability. Your regulators expect a paper trail for every stage. Detailed logs, approvals, and documentation turn the migration into an evidence file that can withstand external review.

- Minimal-to-No Business Disruption. A compliance-ready migration also respects critical operations. When you plan around your peak service hours or critical processes, it ensures your business continues serving people while the data is finding its new home.

Together, these principles of migrating data in regulated industries form the guardrails that keep your move safe and controlled.

Read Also: Salesforce Data Migration Checklist: What to Prepare Before You Start

Regulated Migration Strategy: Stepwise & Compliant

Now, armed with all the info above (risks, challenges, and guiding principles) let’s craft a compliant migration strategy that will keep your business out of the danger zones.

1. Let’s Repeat: Compliance Must Steer Your Ship

Regulators don’t pay attention to how sleek your SF dashboards look if the journey to get there broke the rules.

They expect:

- Complete audit trails that prove who touched which record and when

- Retention discipline so no one can erase data too soon or keep it longer than allowed

- Data safeguards – strong enough to withstand scrutiny from any governing body

Don’t cut corners here. It’s costly: fines, legal action, public trust – they all can go overnight.

2. Cleanse Before You Ship

Dirty data in a regulated industry is a liability. Duplicate patient records in healthcare or mismatched policyholder details in insurance can expose firms to compliance breaches.

Your fix:

- Sort, cleanse, and normalize records before Salesforce data migration

- Decide which records deserve to go, and which belong in archives (or the trash)

Because why carry broken furniture into your new home? It’s surely a metaphor, but we think you get the idea 😉

3. Pick the Right Route

Migrating to Salesforce, how you transport your data matters as much as the destination. There is no one-size-fits-all way. Your choice depends on your data volume & complexity, plus regulatory scrutiny.

You may use:

- Native tools (e.g., Salesforce Data Loader). They are good for straightforward jobs where you need a secure way to move large volumes of records. Data Loader, in particular, supports bulk operations, can be automated via CLI, and integrates with your logging system to prove compliance.

- SF Data Сloud. Ideal when you want not only to migrate to Salesforce, but also to unify and activate your data. The Сloud instantly ingests info from many sources, harmonizes it into a single customer profile, pІus keeps compliance controls baked in.

- Enterprise ETL рlatforms (e.g., Talend, MuleSoft). They are best suited when your data needs heavy transformation, enrichment, or reconciliation across multiple systems. These tools provide encryption in transit and audit logs.

- Specialized Salesforce data migration partner. For high-stakes moves (millions of sensitive records, or multiple legacy systems converging into SF), certified partners bring migration frameworks that include validation scripts, rollback plans, and compliance sign-offs.

Whichever road you take:

- Keep sensitive records encrypted while in motion

- Test in a sandbox before launch (it’s better to find cracks here than in front of regulators)

- Document every step of the journey to satisfy auditors later

4. Audit Every Corner

After the data relocation, don’t just assume everything went OK. Make sure your regulated data migration is successful.

We recommend the following actions:

- Permissions & access controls – validate them. Сonfirm that roles/profiles/sharing rules play their part as they must.

- Check encrурtion & data security. Absolutely: double-check that after the move, fields with sensitive info remain protected and compliant.

- Reports & dashboards in SF – look them through, too. Make sure indicators of performance, key stats (that you need in your daily operations), plus visuals pull accurate data.

- Audit workflows of your business. Confirm and reconfirm that after your Salesforce CRM migration, approvals/automations/daily processes work OK.

- Involve end users in testing. They often spot functional gaps or mismatches faster than your tech crew.

5. Guardrails After Go-Live

Compliance doesn’t end once data appears in SF. The following steps are no less critical than the previous ones in your compliant migration strategy.

So, you’ll have to make:

- Persistent monitoring plus internal audits

- Scheduled clean-ups and periodic access reviews

- Adjustments as laws evolve, so your SF is in sync with your regulator’s playbook

All the above-mentioned points aren’t a once-done checklist. We’d say that your regulated migration strategy is an ongoing discipline – because in finance, healthcare, energy, insurance, or government, regulators don’t forgive “we didn’t know.” They expect proof, precision, and persistence.

Right?

Need a Salesforce data migration partner who knows compliance inside out? Synebo helps regulated businesses move to SF without risks, fines, or sleepless nights. Let’s make your migration safe.

What Regulators Don’t Forgive: Leader Lessons for Salesforce Migration

Leaders in regulated industries can’t afford half-measures for migrations. So, we want to share here some tips from our experience – Salesforce data migration best practices – that will keep transfers safe, credible, and effective for your business.

1. Always Pair Compliance With Tech

For you, data migration to Salesforce cannot remain a solely IT project – we’ve briefly mentioned it before and want to say it again. Compliance must stand on equal footing. When both groups – your IT and compliance people – move in sync, your business avoids painful surprises.

- IT secures the technical execution of data movement

- Compliance validates retention rules, auditability, and standards of privacy

- Their collaboration strengthens your regulatory defense

2. Invite SF Experts Who Know Your Industry

Generic SF knowledge is not enough for finance, healthcare, and other regulation-intensive domains. A certified Salesforce data migration service provider with regulated-industry experience cut risks and accelerate progress.

- They understand sector-specific laws

- They anticipate challenges that inexperienced partners may overlook

- Their involvement keeps projects efficient and defensible

3. Design Thinking About Tomorrow

Laws change fast – faster than systems. You need a Salesforce data migration plan that won’t crumble under new retention or residency requirements. Scalability and adaptability protect the money you invested.

- Modular architecture supports adjustments without full rebuilds

- Configurable access layers adapt to the changing security standards

- Flexible storage strategies accommodate shifting retention rules

4. Track Your Success Beyond Regulatory Checkmarks

Passing an audit is essential.

But it’s not sufficient.

When you migrate data to Salesforce, this shift must also deliver you business value (otherwise, compliance comes at the cost of efficiency).

- Check if people in your organization adopt SF or cling to their old spreadsheets

- Make sure your new CRM improves (or slows down?) workflows

- Calculate the return of your investment (do productivity gains justify the expense?)

By the way, all the Salesforce data migration steps we outlined in the article focus on balancing regulatory obligations with your good performance outcomes.

Cross Finish Line – Safely

So, let us sum up what we wanted to share here – based on our experience. When migration goes wrong in the public, finance, healthcare and suchlike heavily regulated sectors, it can trigger investigations and penalties, unpleasant on their own. Plus – sometimes – it all triggers headlines in the news.

These instantly erode trust in such a non-compliant company.

That’s why Salesforce implementation in regulated industries cannot be treated as a routine task for an IT Dept. You have to safeguard quality before moving records, validate your every step under the spotlight of regulation, and treat SF adoption seriously (as seriously as security).

At Synebo, we provide Salesforce solutions for regulated industries and help enterprises move their most sensitive information into SF without losing control.

If your next transfer involves Salesforce migration, talk to Synebo. Together, we’ll make sure your data arrives safe, compliant, and ready to deliver value for your business or service.