How to Reduce Customer Churn Using Salesforce?

Customer churn can significantly hinder your business growth and is an expensive challenge to tackle. When churn rates exceed industry averages, even by a small margin, it can prevent your company from outpacing competitors and elevating an already successful product or service to new heights.

A small 5% increase in customer retention can significantly enhance revenue, boosting it by 25% to 29%, highlighting the profound impact on profitability. Moreover, the broader research indicates that such an improvement could potentially elevate profits anywhere from 25% to a substantial 95%.

Reducing customer churn begins with predicting it. In this post, you’ll discover what customer churn is, what churn prediction analysis is, how to get churn predictions, and how to reduce customer churn using Salesforce.

What is Churn Prediction?

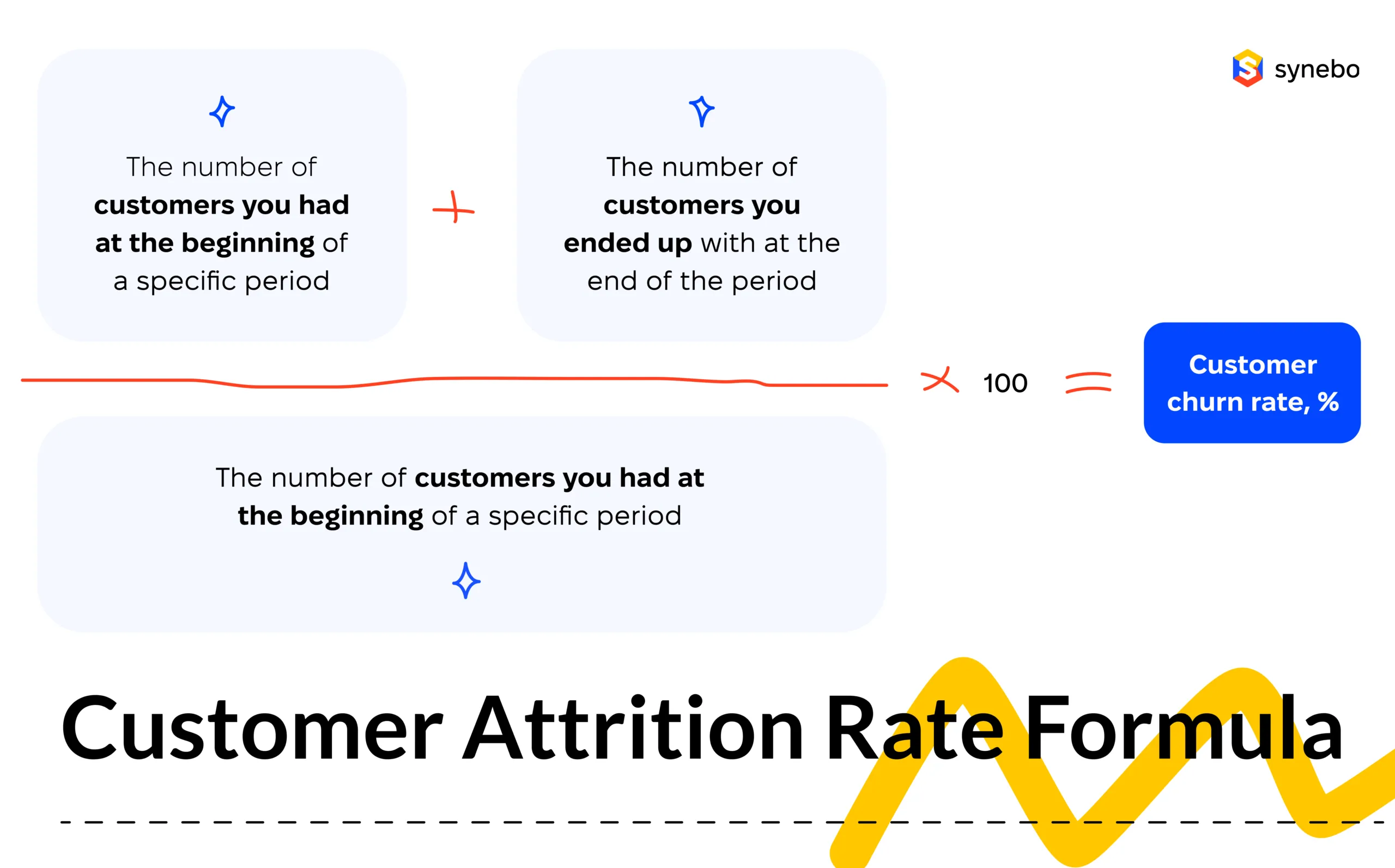

Customer churn (also known as customer attrition, customer defection, or customer turnover) is the percentage of people who stopped using your product or service during a certain time frame.

You can calculate your churn rate by dividing the number of customers you lost during a specific period by the number of customers you had at the beginning of that period.

For instance, if you start your year with 700 customers and end with 650, your churn rate is 7.14% because you lost 7.14% of your customers.

It’s one of the most vital metrics for a SaaS company to track because it gives you the ability to predict that a particular customer is at risk of churning while there is still some time to do something about it.

It’s super important to catch this moment because it costs 6–7 times more to acquire new customers than to retain the existing ones. Furthermore, the probability of selling to an existing client is 60-70% and only 5-20% to a new prospect.

What Are Churn Rates Across Industries?

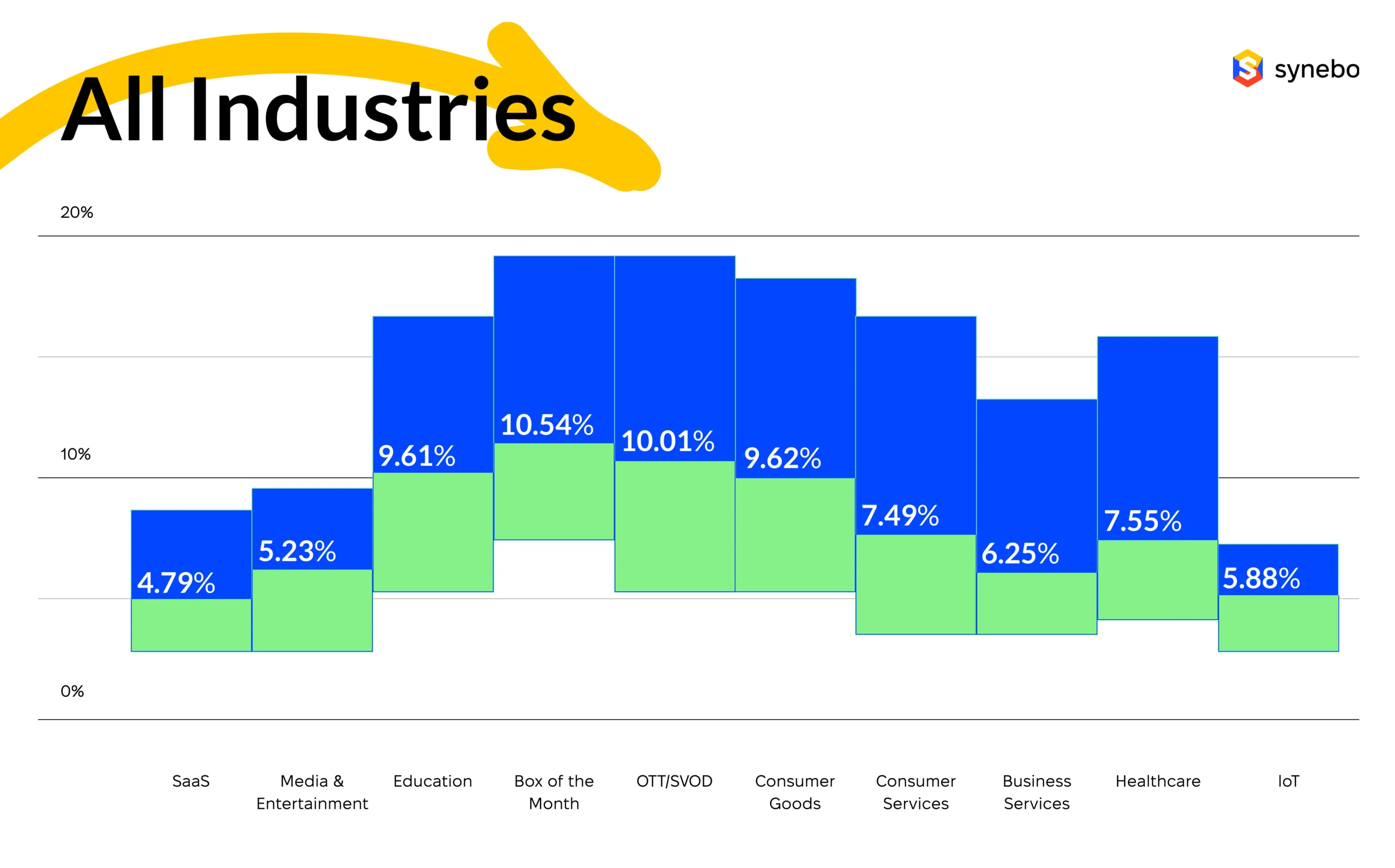

Churn rates vary much across industries and even sectors within them. With different data pointing only towards customer turnover rates among B2B SaaS companies and subscriptions, retailers often struggle to reach exact amounts.

Typically, B2B businesses get average churn rates of around 5% compared with the 7.05% for B2C companies.

As you can see, an acceptable churn rate for SaaS companies is near 5% annually.

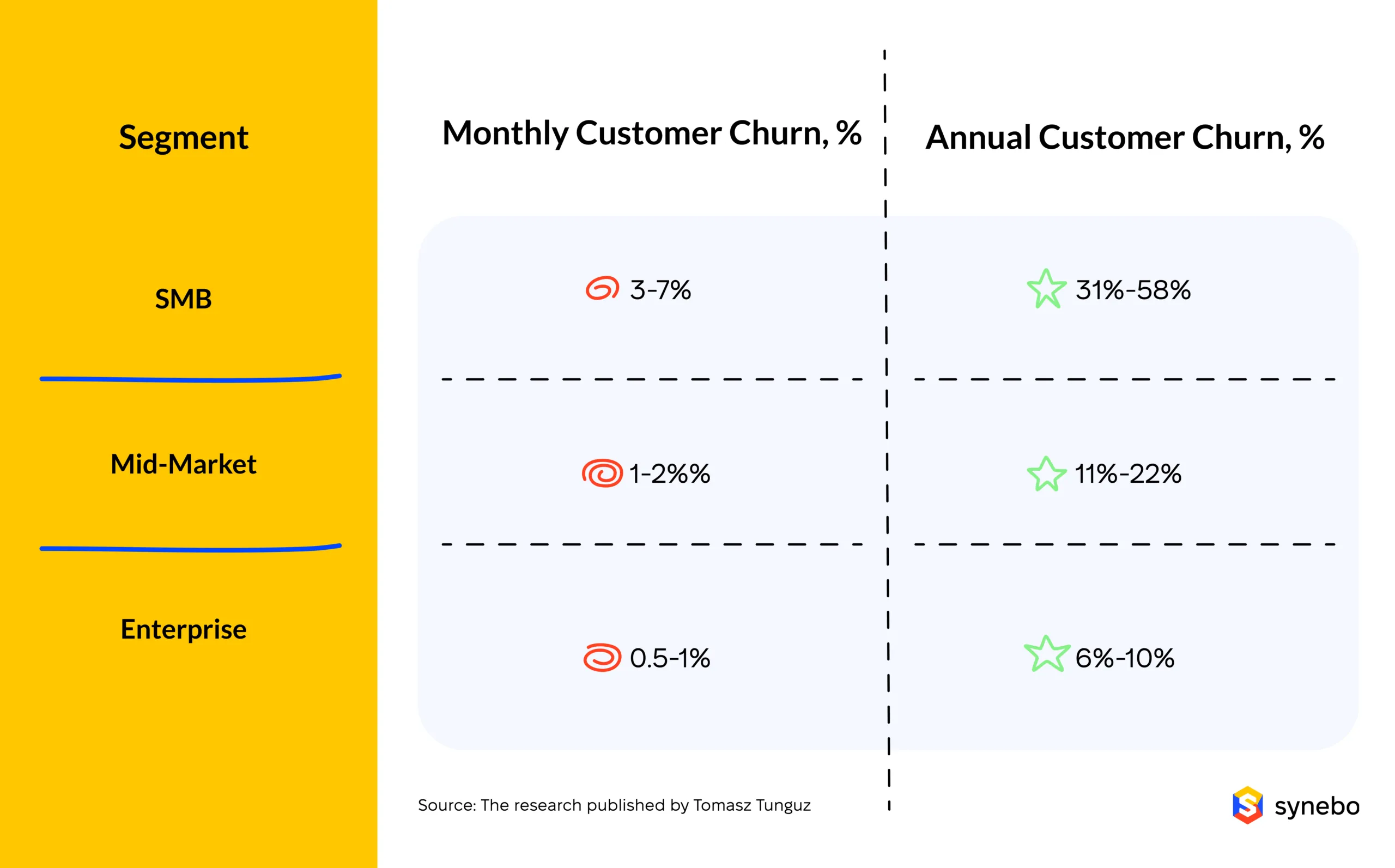

Bessemer Venture Partners, an investor in SaaS businesses, states an acceptable churn rate for these is in the 5 – 7% range annually (0.42 – 0.58% monthly).

However, rates vary depending on the company size. Small and medium-sized enterprises (SMB) customers tend to go out of business more frequently than bigger businesses. That is why an acceptable annual churn rate, in this case, is 31%-58%.

The numbers for Mid-Market are 11%-22% (1-2% monthly) and for Enterprises 6%-10% (0.5-1% per month).

What Is Churn Prediction Analysis?

The customer churn analysis is a way to turn customer attrition rates along with sales and retention metrics into meaningful results.

It will help you:

- Identify clients who are least likely to continue their contracts

- Detect key stages in the customer journey where people are falling off

- Develop strategies to retain high-risk profiles

While SMBs may be able to process this information manually, larger businesses need more robust methods to track the customer journey. When paired with a customer relationship management (CRM) system, customer churn prediction software can quickly analyze the data on a regular basis.

A CRM system, such as Salesforce, top 1 CRM cloud platform, can collect information about prospects and customers like:

- Identity data

- Lifestyle details

- Measurable data points on how your contact has interacted with your brand

- Motivations, attitudes, and behaviors that relate to their buying decisions

After capturing data, the CRM platform groups it into customer profiles, assigning a level of sales-readiness. This feature is prominent not only for lead scoring and lead nurturing but also for identifying your customer’s next move.

Thus, some CRM software deploys Artificial Intelligence (AI) to flag any customers at risk.

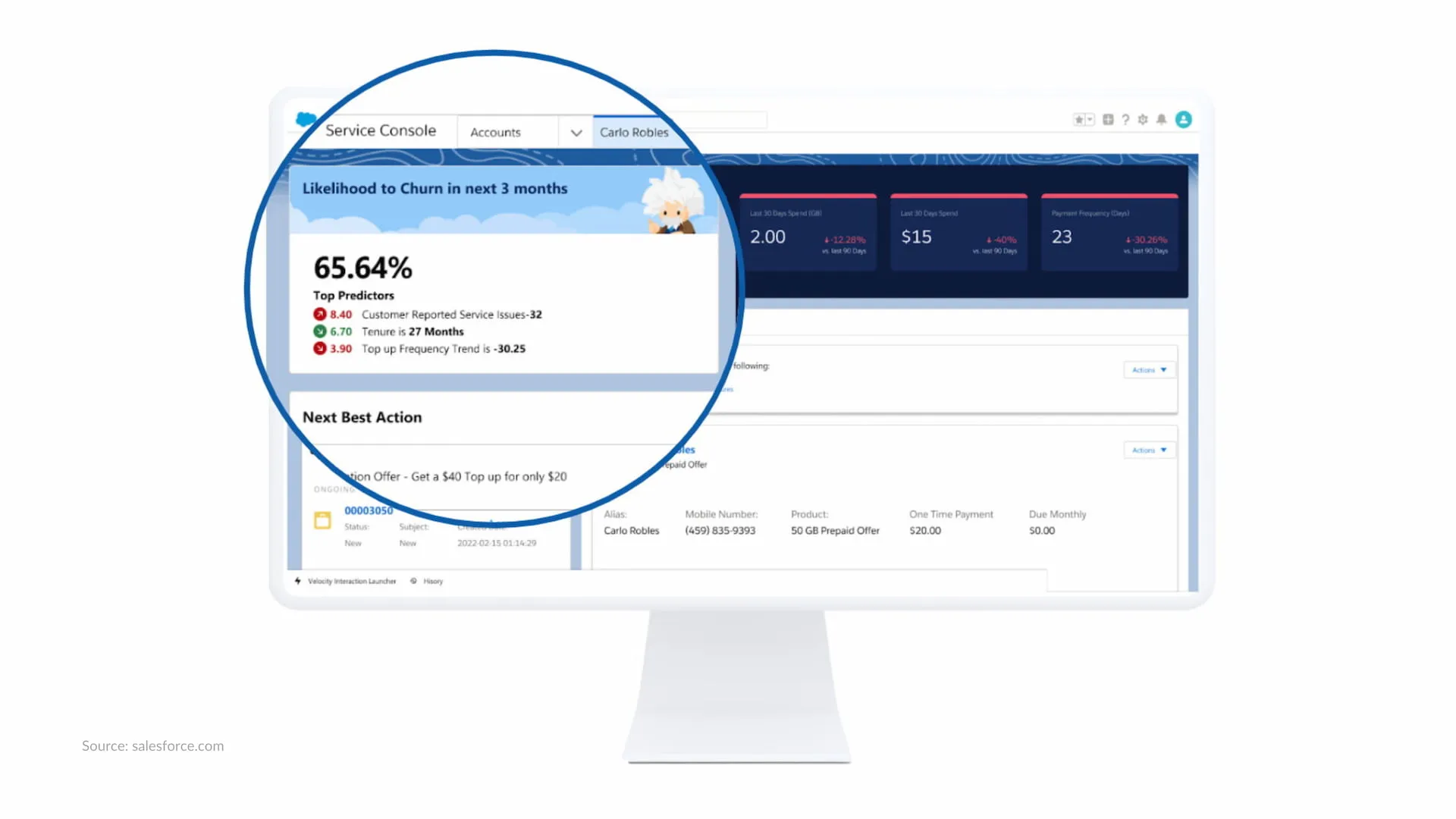

Salesforce launched a new feature that uses AI and analyzes all the data in one click – Salesforce Churn Predictions. Let’s find out how this instrument works.

Using AI, Salesforce Churn Predictions processes customer data and combines it with external data, such as billing and data usage.

It then uses all that information to develop a predictive view of subscribers, such as:

- Satisfaction with the service

- Indications that customers leave the provider

For example, if a particular user posted about a negative experience with your brand on Twitter, your CRM tool can incorporate this information into churn prediction algorithms.

Moreover, algorithms can predict the factors affecting the customers and study future churners by analyzing their behavior. This is a must for understanding the most likely causes of customer dissatisfaction.

Salesforce provides a variety of methods for predicting customer churn, each suited to different levels of technical expertise:

#1 Built-in templates:

- Customer churn risk for retail banking: Utilizes pre-configured analytics to assess churn risks within retail banking data and recommend retention strategies.

- Custom churn models: Enables the creation of tailored churn prediction models from any Salesforce data, allowing for specific configurations and bulk data uploads.

#2 Einstein discovery:

This AI platform offers advanced tools for building custom models using techniques like logistic regression. It’s ideal for those with higher technical skills, offering more precision and flexibility than templates.

#3 AppExchange solutions:

For plug-and-play functionality, numerous third-party apps are available on Salesforce AppExchange, featuring enhanced capabilities such as churn scoring and proactive retention alerts.

Why Do Customers Churn?

Most people don’t just wake up one morning and decide to cancel. Instead, they quit for a reason. While some causes are out of your control, some are addressable.

Below we’ve picked out the top-3 reasons for customer churn and laid out tips to improve customer experience.

Not Providing Value

Customers don’t churn because the price is too high or their budget got cut. Instead, they leave because the value is too low, and they no longer want to pay for non-essential services or products.

But how do you measure value exactly? You don’t. Your customers do, and you have to listen to them and think about their pain points.

Keep asking yourself: “What are the biggest challenges you build this product for?”

If your solution is personalized, customized, and unique compared to potential alternatives, you have everything to start providing a great customer experience.

However, remember that delivery matters. Thus, all Customer Management Processes like onboarding, nurturing, establishing loyalty programs, building community, and asking for feedback are essential for creating more customer value.

Poor Customer Service

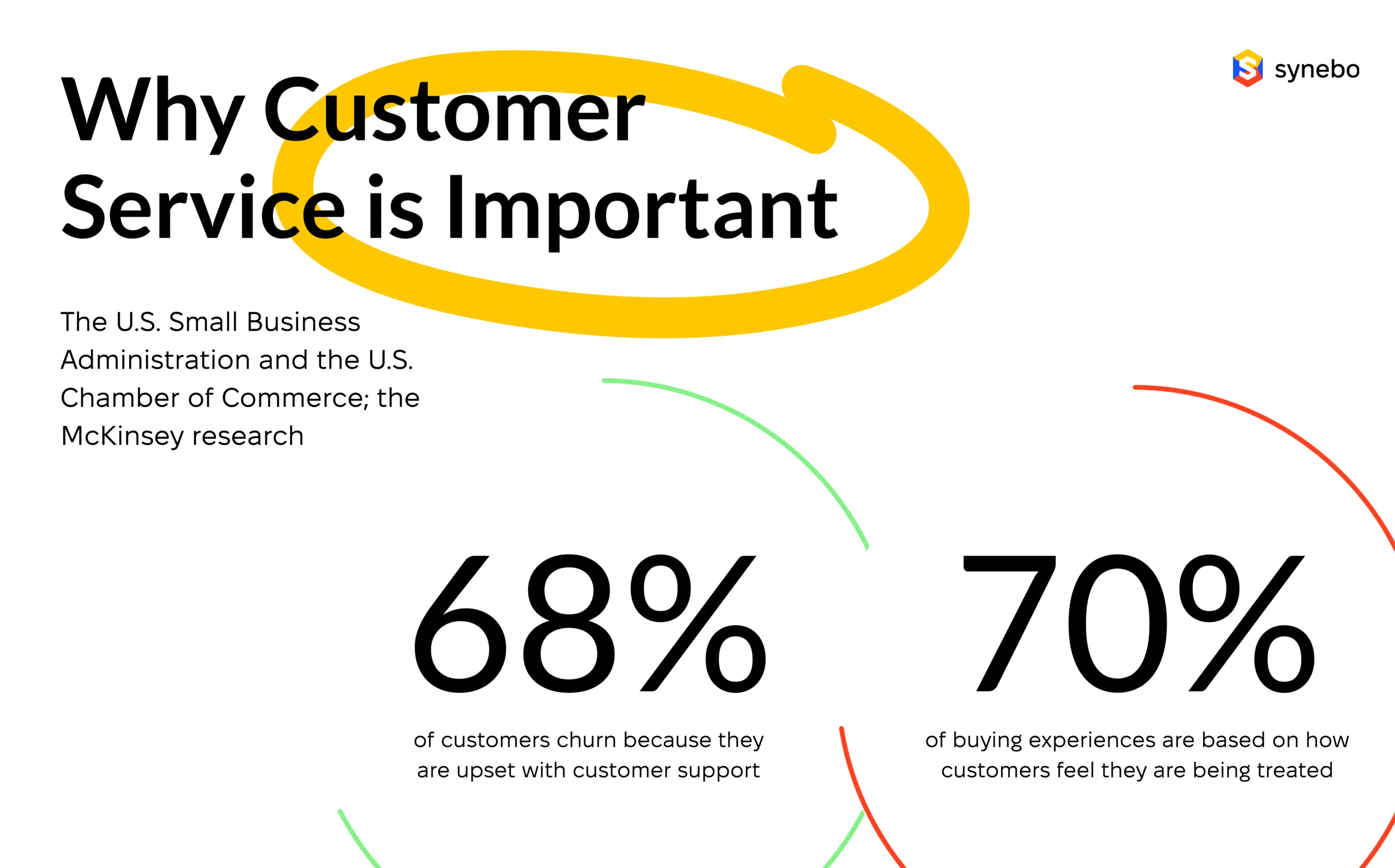

The most prominent reason customers leave is not because they found a better price. Instead, 68% of customers go because they are upset with customer support, reported the U.S. Small Business Administration and the U.S. Chamber of Commerce.

Another piece of data to prove this point is that 89% of luxury customers consider the quality of service as important as the product itself.

When problems occur, clients don’t want to wade through a massive knowledge base or chat with a bot on your website. Instead, they want to talk to real people who can help them.

Unfortunately, bad customer service can often lead to high churn. But there are countless ways you can go about fixing it, depending on the particular problem.

So, we advise you to start by collecting feedback and addressing specific issues. After establishing the source of the customer dissatisfaction, you will see the direction for future tasks. In the end, your customer support should be a priority.

Attracting the Wrong Audience

It’s astonishing how often people sign up for a product or service without knowing whether it meets their needs. When they discover that a product or service isn’t tailored for them, they’ll resign from a contract and choose another company.

Moreover, even companies themselves don’t know who their ideal customer is. So instead, they just target a broad demographic in the hope of attracting their ideal customer. As you can imagine, this tends to be a recipe for disaster.

To avoid this scenario, you need to know who you’re targeting and why.

Here are 4 steps to ensure you attract the right customers:

#1 Create a buyer persona and narrow down the range of customers you’re targeting by disqualifying leads who are not a good fit.

- Leads are your contacts who can become your customers one day.

- The buyer persona is a detailed characterization of someone who represents your target audience. This persona is unreal but based on deep research of your existing or desired audience.

#2 Find out which channels fit your target audience and use them for engagement.

#3 Set up lead nurturing, educating, supporting, and building meaningful relationships with your clients at every stage of the buyer’s journey.

- Lead nurturing is an ongoing valuable engagement with your contacts through all stages of the buyer’s journey. It shines a light on your products or services.

#4 Build a thriving customer community, providing additional trust, insights, networking, and support.

Once you create an environment where the brand and customers can come together to share opinions and get to know each other, it will create bonds that make your solution unique. In addition, a community like this will push the right customers to join.

Top 4 Ideas to Stop Customer Churn

#1: Use a CRM platform with AI churn prediction technology

You don’t have to hire a Data Analyst to predict which clients are most likely to leave your company. Your CRM software can do it. You just need to pick the right CRM tool. Take into consideration that Salesforce is the most frequent pick when it comes to CRM solutions. After that, choose the plan that includes a churn predictions function.

#2: Target the right audience

To simplify the process, you can first define who your Target Audience IS NOT. Remember, you have plenty of data in your CRM and Google Analytics account. Feel free to learn the patterns and continuously revise the results.

#3: Nurture not only leads but customers, too

You have to deliver enough good quality educational content, which will help increase retention and reduce customer attrition rate. So offer free pieces of training, webinars, tutorials, and demos – whatever it takes to re-engage customers.

#4: Pay attention to complaints

Be sure to document ALL complaints and issues brought up by the customer. Once again – a CRM platform can be a great help as complaint management software to search contact history without missing any important records.

How to Reduce Churn Using Salesforce?

Reducing customer churn is crucial for any business, and using Salesforce effectively is a solid way to do so. Here are some top ways to achieve lower customer churn:

#1 Identify and address churn signals early:

Use Salesforce reports and dashboards: Analyze metrics such as login frequency, feature usage, support tickets, and purchase history to spot low engagement or other negative signals.

Set up triggers and alerts: Configure notifications for activities indicating potential churn, such as failed payments or prolonged inactivity, to enable timely interventions.

#2 Personalize and re-engage customers:

Segmentation and targeted campaigns: Group customers by usage patterns, needs, and risk of churn. Deliver personalized communications like email campaigns or in-app messages with targeted incentives.

Trigger-based automation: Implement automated email sequences that activate based on specific behaviors, such as reduced usage or nearing the end of a contract, to encourage continued engagement.

#3 Enhance customer experience and value:

Leverage Salesforce Service Cloud: Optimize support processes, enhance self-service options, and personalize interactions to improve satisfaction and reduce churn.

Product feedback and feature updates: Use Salesforce to collect and integrate customer feedback into product enhancements, communicating updates effectively to show commitment to customer success.

#4 Foster customer loyalty and community:

Salesforce customer communities: Develop an online community for customers to interact, share tips, and connect with your brand, enhancing loyalty and reducing churn.

Loyalty programs and exclusive offers: Provide rewards such as exclusive discounts or early access to new features to encourage loyalty and deter churn.

#5 Bonus tips

Integrate with other tools: Use third-party apps and tools that complement Salesforce to enhance your capabilities, such as predictive analytics for identifying churn-prone customers or marketing automation for personalized campaigns.

Measure and iterate: Continuously monitor and evaluate the effectiveness of your churn reduction strategies, making adjustments based on insights to optimize results.

Final Take

leveraging Salesforce for churn prediction and prevention is useful for any business aiming to reduce customer loss and enhance growth. By utilizing Salesforce CRM platforms and its tools like Einstein Discovery and various AppExchange solutions, companies can effectively predict and mitigate customer churn.

Should you need assistance ith Salesforce CRM implementation for reducing customer churn, don’t hesitate to drop Synebo a line. We are a certified Salesforce agency specializing in creating tailored software solutions to business needs.

Contact us, and let’s discuss opportunities.